The Russian ruble hit its highest levels in two weeks on Tuesday, shored up by informal capital control measures designed to head off a repeat of the galloping inflation and mass protests that marked Russia's 1998 financial crisis.

The government put pressure on state-owned exporters on Tuesday to sell dollars while officials and banking sources said the central bank had installed supervisors at the currency trading desks of top state banks.

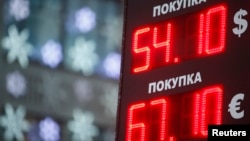

Shortly after the market opening, the ruble hit 52.88 to the dollar, its strongest level since December 8. By 1225 GMT, it had fallen back but was still was up 2.3 percent at 54.52.

Analysts said the measures were effectively a softer version of capital controls, adding that they did not believe President Vladimir Putin, who has drawn much of his popularity from financial stability and rising prosperity, would break his pledge not to resort to full-fledged controls.

Russians have followed hard currency movements closely ever since hyperinflation destroyed their savings after the collapse of the Soviet Union, just before Putin came to power.

The ruble plunged to an all-time low in mid-December on the back of lower oil prices and Western sanctions, which make it almost impossible for Russian firms to borrow from the West.

Economic crisis

Former finance minister Alexei Kudrin warned on Monday that Russia was heading toward a full-fledged economic crisis.

The ruble fell to as low as 80 per dollar this month, from the average of 30-35 seen in the first half of the year, but has since recovered to trade as high as 52.88 to the dollar on Tuesday.

On Tuesday, the government asked top state exporters to sell part of their hard currency revenues on the market, a government source told Reuters.

“Of course, the companies are free to hold on to the hard currency, they are also free to get involved in speculative operations. But then we reserve the right not to help them if and when they hit tough times,” said a government source who asked not to be named.

He said companies that needed to repay large foreign debts could continue to accumulate hard currency.

“If exporters are told not to increase their hard currency positions, it can be viewed as an unofficial reintroduction of capital controls,” said Vladimir Osakovsky from Bank of America Merrill Lynch.

Liza Ermolenko, an emerging market economist at Capital Economics in London, said: “I don't think we can call them capital controls as such. ... Capital controls is a very strong policy and if they decided to do it, it would be known.”

Limiting money flows, once considered a damaging constraint on open markets, has been more accepted in the aftermath of the 2008-2009 financial crisis as a tool sometimes needed to manage financial stability.

Political issue

But in Russia, the issue is a political one. Capital movements were liberalized only 10 years ago and any restrictions bring back memories of the chaotic post-Soviet financial turbulence which Putin, now in his 15th year as Russia's paramount leader, made it his mission to banish.

“(Full capital controls) would be a huge immediate blow to the economy,” Mikhail Zadornov, chairman of the board of VTB-24 bank, told the newspaper Vedomosti in an interview on Tuesday.

“It would intensify capital outflows and cause a complete loss of confidence in the country among both domestic and foreign investors," Zadornov said.

Instead, Russian authorities are taking a more pragmatic approach.

Four banking sources and sources close to the government said that the central bank had last week begun sending supervisors to monitor currency trading at major Russian banks.

“There was panic,” said a source close to the government. “Something had to be done and we took some measures.”

The central bank expects net capital outflows to hit $130 billion this year and Russia can ill afford to lose any more, with economists forecasting that an already slowing economy will shrink 3.6 percent next year.

“Yes, we have to report all of our activities to them, they are very meticulous,” said a source at a bank among Russia's top five.

'Currency comptrollers'

Another source at a large bank said: “As of Monday (December 16), currency comptrollers have been sitting in and monitoring our currency positions, checking who bought foreign currency.”

The central bank declined to comment on this, telling Reuters only that it would hold talks with exporters about maintaining stability on the foreign exchange market.

Traders said Tuesday's ruble rise was due partly to the government orders and partly to regular tax payments, which require exporters to sell dollars or euros for rubles. The tax payments are likely to peak around December 25.

The newspaper Kommersant said, citing unnamed sources, that the companies asked by the government to sell hard currency included the gas firm Gazprom, the oil firms Rosneft and Zarubezhneft, and the diamond producers Alrosa and Kristall.

Kristall confirmed to Reuters that it had received the instruction. One other company from the list also confirmed the instructions, but asked not to be named.