“A strong private sector is crucial to broad based economic growth, and this is especially true to post conflict African states such as Liberia, Ivory Coast and Sierra Leone as well as a host of others in Africa, ”says Hany Besada, a senior researcher and the head of the Development Corporation Program at the North-South Institute in Ottawa, Canada.

Through its research, the non-governmental institute supports, among others, global efforts to increase aid effectiveness, strengthen governance and accountability, and promote equitable trade and commercial relations.

According to Besada, “the relationship between the private sector and post conflict African states are good and are constantly improving.”

That was not always the case.

Rough start

Socialism was the choice of many African independence leaders, and with it, a preference for government-managed enterprises and a command economy over private-owned businesses and a minimum of government regulation.

In some countries, private enterprise was linked to cronyism, corruption and even civil war. Over the past two decades, private sector actors have been involved in the illegal mining and transfer of blood diamonds in Sierra Leone, and in the illegal shipments of arms and soldiers in Ivory Coast and Liberia.

“This history,” Besada says,” still continues to hang over them, as governments and officials in the three countries at times are quick to point out the disastrous effects on the economies and the political stability given the private sector role and action during civil conflicts. “

New efforts in post-conflict states

But African economies have grown particularly over the past decade, in part due to foreign investment and to increased support for private sector expansion.

Development institutes like Besada’s and the African Capacity Building Foundation (http://www.acbf-pact.org/) encourage good governance, broad-based economic growth and capacity building for both the private sector and government.

Besada says that’s true of Liberia and other countries in West Africa.

“Shortly after the election of Johnson Sirleaf as President of Liberia,” says Besada, “she declared the private sector’s involvement would need to be integral to Liberia’s rehabilitation.”

He says her government inherited a budget of less than $ [US] 100 million in 2006 sharply down from the pre-coup national budget of $ [US] 600 million in 1980. Sirleaf was forced to raise capital and resources for reconstruction, including the revival of privately-owned businesses, especially in mining, agriculture, rubber production, and logging.

The story is similar in Sierra Leone, which is rebuilding from decades of civil war. The government there is working to attract foreign investment, in part with a program that aims to privatize many state owned enterprises and spur economic growth.

Besada says it’s the cornerstone of its strategy for national development which in time will reduce the role of government in the economy, and encourage local businesses to create jobs.

In Cote d’Ivoire, there have been a number of changes to the country’s business regulations. Goods and services that are manufactured and conducted in free trade zones are now exempt from all import and export duties.

Taxes in the zones are extremely low, with numerous rebates based on local employment and reinvestment. Foreign and local investors are now exempt from the national value added tax on electricity, water, and petroleum consumption. They are also protected by law from nationalization, and they face no restrictions on ownership.

“These kinds of measures reflect post conflict African states’ eagerness to work with the private sector,” says Besada.

Take-off

In the past few years, private entrepreneurship has helped other economies take off.

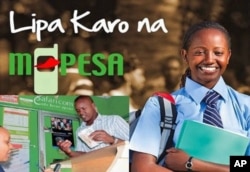

In Kenya, according to Besada, “Mpesa,” the country’s first mobile banking service network, directly led to the creation of over 7,000 enterprises and 12,000 jobs. The subsequent increase in access to financial services is also likely to have generated many jobs indirectly.

In Namibia, Besada says, “Namdeb, the diamond operation based on a partnership between the government and De Beers, accounts for more than 10% of the country’s gross national product.

In Botswana, Besada says “private sector investment has helped transform the country from one of the poorest countries in Africa, to a middle income country.

He also points out that South Africa’s business involvement in the rest of the continent had a marked effect in terms of structure to the labor market, more specifically on wage levels and job creation.

In Mozambique, Besada says “the entry of South African companies into the job market has had a striking impact on wage structure. The highest paid labor group in the country is the skilled workers at the Mozal smelter. Today, the lowest paid worker earns $4,000 there, which is 10 times the minimum wage. ”

Injecting needed capital

The domestic private sector needs lots of financial support to grow and flourish particularly in post conflict states. Besada points out that foreign investments help inject needed capital in the local economy that are made available for local investments later on. It’s a trickle effect, says Besada, that also helps promote skills transfer and increases productivity levels.

Two important investors in Africa are India and China.

India’s investments on the continent are largely driven by its private sector. Besada says India is keen to move away from formal arrangements between governments and is focusing more on local partnerships through the exchange of managers and skilled laborers.

China, Besada says, has helped promote skills transfer in Africa, including in Egypt’s manufacturing sector and Zambia’s mining sector.

However, Beijing has been the focus of criticism. African governments criticize China for supplying its own manpower in African projects, rather than using local workers. Some says it also drives African retailers out of business with cheaply made goods imported from China.

Beijing has begun to react to some of these criticisms. Over the past few years, Beijing has pumped millions of dollars into African industries geared to serve markets in the EU and the United States.

Using the provisions of the EU’s Cotonou Agreement and the US African Growth and Opportunity Act, Chinese investors have established joint ventures with local investors to produce goods for exports at concessional rates.

The Chinese are especially involved in agriculture, agro-business, textiles, and light manufacturing. In the process, says Besada, they are helping to build local capacity, boost technology transfers, and raise the export levels of dozens of Africa economies.

Besada says traders from Asia, and the Middle East have been in coastal Africa for decades, though they have at times been driven from the continent. Some African leaders accused them of not sharing skills, or wealth, with the African business community.

As a result, today, Lebanese traders in West Africa are partnership more with local investors while Indian investors in East Africa are using more local workers as part of their work forces while wages levels are increasing.