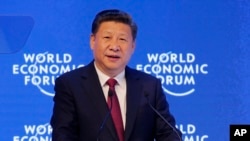

Chinese President Xi Jinping warned governments of the dangers of a trade war while speaking at the World Economic Forum in Davos, Switzerland on Tuesday.

"Pursuing protectionism is like locking oneself in a dark room. Wind and rain may be kept outside, but so is light and air," he said in an obvious reference to U.S. President-elect Donald Trump, who has promised to impose a 45 percent tax on Chinese goods, and a 35 percent tax on German vehicles manufactured outside the United States.

China's answer to Donald Trump

"What Xi has done is clarified China's position, which is that a trade war would be costly for all countries," Kerry Brown, Professor of Chinese Studies and director of the Lau China Institute at King's College in London told VOA. "I think China will watch for the decisions Trump takes after becoming president, and then identify the soft or hard [actions] it needs to take to defend itself.”

Xi also spoke of China’s massive resources to prove that Beijing is capable of providing massive amounts of business to countries that do not oppose Beijing's interests. China will spend $8 trillion in imports and invest $750 billion in overseas businesses in the next five years. Chinese tourists will make 700 million foreign trips supporting the world economy in the coming five years he said.

China's economic hard times

But critics point out that this may be the worst time for China to make such promises.

The country, which is undergoing an economic slowdown, is expected to suffer some serious economic setbacks in 2017. This would include a sharp decline in the country's ability to attract foreign investments, and selling shares and bonds in western markets this year. Chinese officials have said they expect a slower growth in foreign investment inflows in 2017 after a lackluster performance last year.

At stake is not just economic but also China's political clout, and its ability to counter expected adverse actions from the next U.S. administration. In addition to the tax on Chinese goods, Trump has promised to closely examine Chinese investments in the U.S..

China's diplomacy dependent on a robust economy

China's diplomacy has thrived in recent years on its ability to import and invest billions of dollars. Leaders of major countries routinely visit Beijing or host Chinese leaders with sales pitches for deals relating to airplanes, heavy machinery and high-end technologies.

Beijing managed to use its economic prowess to drive its political agenda in different countries and organizations, including the Association of South Eastern Asian Nations (ASEAN). But analysts say the country's economic slowdown will result in a dilution of its political influence, and in turn make it difficult for Beijing to effectively counter the likely moves by Trump in the coming weeks and months.

China's influence in ASEAN is tied to its economic clout

"Chinese influence in ASEAN has been buoyed by trade and investments, and even managed to counter the influence of the U.S. and Japan," Thomas Eder, research associate at the Berlin based Mecator Institute of China Studies told VOA.

ASEAN has been divided on what kind of stand it should take on the South China Sea dispute that involves half of its 10 member countries. But China has often managed to block any discussion on the subject at ASEAN meetings.

"China has compounded the difficulty of ASEAN reaching a consensus position against it. This was done by using the lure of investments, which played a role in making Cambodia a defender of Chinese interests within the organization," Eder said. "As a chair of ASEAN, Cambodia saw to it that China's behavior in the South China Sea would not be condemned in an ASEAN summit declaration.”

China's economic influence not what it was

China is no longer as capable as it was earlier to buy goods and invest heavily across the world because it is facing severe economic slowdown at home. China's trade surplus fell for the first time in five years slipping 14 percent to $510 billion in 2016, according to figures released on Monday.

The country's imports also slipped 5.5 percent last year. Chinese exporters faced 119 anti-dumping investigations in 2016, an increase of 37 percent compared to the previous year. The ongoing investigations will thwart Beijing's efforts to increase exports even after the recent devaluation of the Yuan, which is aimed to assist exporters.

Foreign direct investments grew at 4.1 percent reaching $118 billion in 2016, which was far lower than the 6.4 percent rate seen in 2015. And economic officials in Beijing recently said they expected a weaker performance in 2017.

China has imposed stiff restrictions on foreign investments by Chinese companies in what is seen as a desperate effort to shore up falling investments in the domestic economy.

"Certain countries like Vietnam will strive to diversify their trade and investment relations away from China," Eder said, discussing the consequences of the country's economic slowdown and the likelihood of trade and political frictions with the U.S.

Any increase in U.S.-China frictions would result in uncertainties thwarting growth in investments as businesses shy away from taking big risks. This will put greater pressure on Beijing to persuade Southeast Asian countries and Taiwan to toe its line, analysts said.

"Beijing will counter the situation by pushing for more deals along its "maritime silk road" and try to keep investment levels at least stable," Eder said.

China has friends in Taiwan

Some of China's strongest supporters have been Taiwanese businessmen who have strong links with China. More than 40 percent of Taiwan's trade is with China. But Trump has managed to infuse a sense of uncertainty by questioning Beijing's claim on Taiwan through its one-China policy. China has rejected the move and its official media have warned that Trump is "playing with fire.”

But David Gosset, Director of Academia Sinica Europaea, China Europe International Business School, believes the United States would not be able to weaken China's influence in Taiwan. "What will happen to Taiwanese companies like Foxconn without China's economic dynamics? The economic convergence between Taiwan and Mainland China is a reality, and any amount of manipulation by the United States would not change the situation on the ground," he said.

Gosset said the United States is unable to provide an alternative solution to the economic needs of most Asian countries, which is met by China because of its economic size and geographical proximity.