China's slowing economy has caught the attention of some U.S. policymakers and other observers, who warn not to underestimate the Asian country and who also see opportunities for more Chinese investment in the United States.

At a recent congressional hearing, Representative Matt Salmon said China's "quest for development and global influence has come at a high cost of alienating partners and allies alike.

"There are cracks in the foundation, and imbalances remain politically, economically and militarily," the Arizona Republican said.

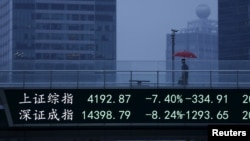

China’s economic growth has been slowing, declining to less than 8 percent in 2014 from double-digit figures a few years back, according to its government's statistics.

The International Monetary Fund (IMF) showed the country's GDP at 7.4 percent in 2014 and projected it would decelerate to 6.8 percent this year.

Derek Scissors, a resident scholar at the American Enterprise Institute, said China’s stall is "not avoidable ... as the problem is more than a decade old at this point."

“The government is going to report whatever it wants, because that’s the government and it can report whatever economic statistics it likes," he said. "But by the end of this decade, it will be unmistakable that China is no longer growing economically unless significant market reforms are resumed.”

Decade of decline

Scissors said the Chinese economy started going downhill in 2003 when “the then new government under Hu Jintao pushed aside market reforms in favor of public investment, directing the finance by the state largely through state-owned enterprises.”

“From 2003 to 2008, Chinese economy [was] getting bigger and getting less healthy,” he said. The following year, it started to show signs of stagnation.

At a recent congressional hearing, Pennsylvania Republican Scott Perry asked whether stagnation will lead to China's economic collapse.

"If we believe what we have is right and what they have is wrong and can’t endure, are we close to the end? Is the end 50 years away? When will it collapse under its own weight?" Perry asked.

Scissors said he doesn’t believe stagnation will necessarily translate to China’s collapse. He said China's economic stagnation does not mean the country has lost its significance in the world.

"The mixed economy that China has doesn't lend itself [to] acute economic crisis," Scissors said.

He suggested the Chinese Communist Party has exaggerated its GDP growth, "but even then, it’s on a straight line down. The growth, aging debt, all of this says stagnation. We have seen this country can stay stuck for a long time without instability.”

Creative responses

Jerome Cohen, a professor at New York University, said China is facing a lot of international economic challenges, but he said the U.S. shouldn’t underestimate Chinese leaders' creativity and dynamism in meeting them.

The Asian Infrastructure Investment Bank and related institutions "are an example of their giving an imaginative response that put the U.S. government back at its heels with a surprise,” Cohen told participants at the hearing.

He added that many authoritarian governments, including China's, have been able to maintain steady economic growth. But, "the very economic progress leads to the kind of ferment that we are beginning to witness in China.”

"What the outcome of that ferment would be is really in part up to us, mostly up to the Chinese people."

Consequences?

Salmon asked scholars at the hearing to assess and explore the consequences of a slowed Chinese economic machine on the U.S. economy.

For years, Scissors said, many were concerned that Western free market economies could be challenged by “the Chinese economic model.” However, he said, the Chinese model and its impact are fading.

"I was sitting in front of Congress in 2009 when people were panicked that China [was] taking over the world," he said. "I think that panic has receded considerably."

Scissors said he thought that though China "has peaked economically. ... China is not going to become small, but the fear we had of China overtaking us, eclipsing the way we do things, is already gone. If it isn’t already gone, it will be gone for everyone in a few years.”

Still, Scissors told congressional lawmakers that the United States must be prepared.

With China's economy stagnating, Chinese investment would more likely flow into the U.S., Scissors said. He cautioned the U.S. policymakers on decisions on where and how much Chinese investment should be allowed in the country.