WASHINGTON —

What is the U.S. Fiscal Cliff?

No compromise so far

Wrangle over deficit and debt

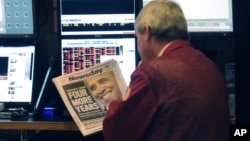

With the U.S. elections over, President Barack Obama and Congress are turning their attention to the political stalemate called the “fiscal cliff.” It is a tangle of major spending cuts and tax increases that could stall the national economy unless Democrats and Republicans quickly forge compromises.

The United States faces $600 billion in automatic tax increases and spending cuts that go into effect January 1, unless the two major political parties can reach an agreement.

The cuts would affect both the military spending favored by Republicans and the social programs supported by Democrats. President Obama's Democratic Party controls the U.S. Senate, while Republicans have a majority in the House of Representatives.

On taxes, a key issue is whether to extend tax-rate reductions that have been in effect for years, but are due to expire at the end of 2012. The reduced tax rates apply to all Americans, whatever their income. Republican lawmakers say they want to continue all of the reduced rates; Obama and leaders of his Democratic Party have been trying to exclude this benefit extension for the country's wealthiest taxpayers - probably everyone whose family income is more than $250,000 a year.

The law mandating the cuts in 2013 was intended to force lawmakers to compromise on where and how much to reduce spending and raise revenue to reduce the federal budget deficit.

What Is the US Fiscal Cliff?

What is the U.S. Fiscal Cliff?

- An agreement intended to force politicians to compromise and make deals.

- Without a deal by January 1, 2013, sharp spending cuts would hit military and social programs.

- Tax hikes also would go into effect.

- The combination would reduce economic activity, and could boost unemployment and push the nation back into recession.

Neither side has changed its position, so the effort to force compromise has been a failure, but the spending cuts and tax increases are mandatory.

Leon LaBrecque, chief strategist and founder of LJPR, a firm that manages nearly $500 million in assets for investors, says, "It very difficult to believe, although possible, that Congress and the president can solve these problems before December 31."

Economists say that cutting spending and raising taxes so sharply would reduce demand for goods and services, slow economic growth and increase unemployment - and possibly push the United States back into recession.

Josh Gordon, policy director of The Concord Coalition, a nonpartisan organization that focuses on federal budget issues, takes a more optimistic view than LaBrecque. He says Congress and the Obama administration probably will agree at least on an outline for a compromise.

Washington's annual budget deficits have been running higher than $1 trillion, pushing the total U.S. debt closer to the maximum legal limit, or debt ceiling; that limit has been adjusted upward many times during the past decade and now is about $16 trillion. The president and Congress must decide early in the new year whether to allow debt to rise beyond $16 trillion. Obama has pledged to work for a plan that would reduce the national debt level over a period of years, but he has been unable to reach an agreement on that issue with his political opponents.

Wrangle over deficit and debt

Former Treasury Department official Kent Smetters says a key reason for the growing debt is the spending obligations the government has on old-age pensions and medical care for the elderly and poor. Smetters, who now teaches economics at the Wharton School of the University of Pennsylvania, says the “fiscal cliff” debate is a chance to rethink federal spending overall.

He says "the real cliff" is the mounting level of debt that discourages investors. Smetters says Washington must make comprehensive reforms on spending and taxes with laws crafted to encourage economic growth.

He says "the real cliff" is the mounting level of debt that discourages investors. Smetters says Washington must make comprehensive reforms on spending and taxes with laws crafted to encourage economic growth.

Pressure on the president and congressional Republicans to force themselves to agree on these issues increased after the election, when the Fitch financial rating agency said it might reduce the credit rating for U.S. financial instruments unless there is a debt compromise. Such actions already have been taken or threatened by other rating agencies.

Fitch said political leaders from both major U.S. parties must work out a "credible" plan for deficit reduction, and find a way to raise the legal limit on government borrowing.

Fitch said political leaders from both major U.S. parties must work out a "credible" plan for deficit reduction, and find a way to raise the legal limit on government borrowing.