Being president of the United States comes with numerous perks and the fringe benefits continue decades after the nation’s chief executives exit the White House.

Presidents are currently paid $400,000 annually, an amount set by Congress. The nation’s leaders have received five pay increases since 1789, when George Washington became the country’s first president.

Washington, and the 17 chief executives who followed him, were paid $25,000. In 1873, presidents got a raise to $50,000. In 1909, the presidential paycheck increased to $75,000 annually.

When President Harry Truman started his second term in 1949, he got a raise to $100,000. President Richard Nixon was the first president to get $200,000 in 1969. The current rate of $400,000 took effect in 2001 with President George. W. Bush.

The perks of being president include a pretty nice place to live for free (The White House); a battalion of servants led by butlers and a head housekeeper; a trained chef to cook your meals; a fitness center that comes with a private trainer; your own private movie theater and bowling alley; a country retreat (Camp David); round-the clock security (U.S. Secret Service); use of an airplane (Air Force One) and a helicopter (Marine One) and your own bullet- and bomb-proof limousine (The Beast).

And the extras don’t disappear once a president leaves office. Former chief executives currently receive an annual pension of $213,600, which is what cabinet secretaries make.

Pensions and other allowances were set in place in 1958 after President Truman faced lean times after leaving office.

Unlike many other ex-presidents, Truman wasn’t rich and worried about accepting offers that gave the appearance of cashing in on the presidency. However, he eventually sold his memoirs to Life magazine for $600,000, about $5.7 million in today’s dollars, which allowed him to live comfortably in retirement.

Today, not only do ex-presidents draw a pension, taxpayers also give them money for post-presidential travel and business expenses like setting up their own office anywhere in the country.

“There are responsibilities that carry over after a president leaves office, which is the justification for providing an office allowance,” Demian Brady, director of Research with the National Taxpayers Union Foundation (NTUF), told VOA by email.

“While staff compensation is limited to $150,000 for the first 30 months, then capped at $96,000 per year, there are no limits on the size or location of the office space. And the allowance is open ended.”

Since 2000, taxpayers have paid nearly $68 million — not including the costs of secret service protection — to support former presidents, according to an NTUF analysis.

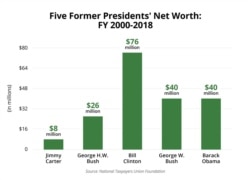

Bill Clinton has received the most benefits — $21 million — since 2000. Clinton has an estimated personal net worth of more than $70 million. When calculated by year, Barack Obama has collected the most — $1.4 million per year — followed by George W. Bush at $1.2 million per year. Both men are also worth millions.

Brady says these payouts basically amount to subsidizing millionaires given that today’s ex-presidents can get rich off speaking fees, book deals and other lucrative business deals.

“No one wants to see presidents in poverty, but that is not much of a concern in the modern era,” he says. “Reforms to save money here could look to providing a base amount for rent and furnishing and, consider putting a time limit on the allowance...If there are special circumstances imposed on a former president that would require additional time, this could be authorized through legislation.”

In 2016, President Obama vetoed a measure to cap office allowances for former presidents at $200,000 per year. A bipartisan bill to limit taxpayer benefits for ex-presidents was introduced in May 2019 and remains under consideration.