Negotiations to restructure Lebanon's foreign currency debt should not last more than nine months if well-intentioned, the economy minister was quoted as saying, after the heavily indebted state said it could not meet its debt repayments.

Lebanon is set to default on its sovereign debt after declaring on Saturday it could not pay forthcoming maturities - the first of which is a $1.2 billion bond due on Monday. The state has called for restructuring negotiations.

The country is grappling with a major financial crisis which came to a head last year as capital inflows slowed and protests erupted over decades of state corruption and bad governance.

The default will mark a new phase in a crisis that has hammered the economy since October, slicing around 40% off the value of the currency, denying savers free access to their deposits and fueling unemployment and unrest.

Face-to-face negotiations between Lebanon and bond holders are expected to begin in about two weeks, a source familiar with the matter told Reuters on Sunday.

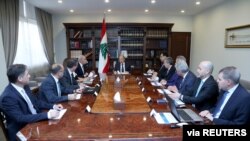

Prime Minister Hassan Diab, in a televised address to the nation on Saturday, said foreign currency reserves had hit a "critical and dangerous" level and were needed for basic imports.

"The negotiation process will last for months and if we have good intentions will not go on for more than nine months," Raoul Nehme, the economy minister, told broadcaster al-Jadeed in comments published on its website overnight.

Lebanon has a total of some $31 billion in dollar bonds that sources have said the government will seek to restructure.

Lebanon's banks, big holders of the sovereign debt, are ready to talk with the foreign creditors as the government seeks to restructure its debt, a source familiar with the matter said on Saturday.

There was no timetable yet for any restructuring and the discussions with foreign creditors are likely to start slowly, the source added. Houlihan Lokey has been appointed financial adviser by the Association of Banks in Lebanon to help with the process, the source said.

Diab said public debt has reached around 170% of gross domestic product, meaning Lebanon is close to being the world's most heavily indebted state.

The financial crisis is seen as the biggest risk to Lebanon's stability since the end of the 1975-90 civil war.

There has been no sign of a bailout from foreign states that aided Lebanon in the past. Western governments insist Beirut first enact long-delayed reforms to fight waste and corruption.

Many analysts believe that the only way for Lebanon to secure financial support would be through an IMF program.

But this is opposed by the powerful, Iran-backed Lebanese group Hezbollah, which has said the kind of terms the IMF would seek to impose would cause a "popular revolution" in Lebanon.

Lebanon has however sought technical assistance from the IMF.