For years, China’s property market has been a bubble, fueled by growing middle-class wealth, demand for housing in cities, a preference for investing in property rather than stocks, and easy credit for eager developers who use their connections with local governments to buy up land to develop into housing.

The property bubble, however, burst in late 2021 when China Evergrande Group, one of the country’s biggest property developers, defaulted on debt which rose to $340 billion by the end of last year. This month, another major developer, Country Garden, defaulted on millions of dollars of interest payments linked to two offshore bonds and warned of a net loss. Other developers could also be in trouble.

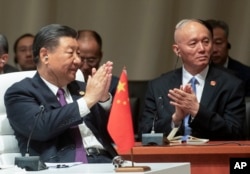

President Xi Jinping is unlikely to follow the example of previous administrations, which pumped money “like crazy” into the sector accounting for about 30% of the world's second-largest economy during the last big property market downturn in 2008, according to Shanghai-based economist Andy Xie, Morgan Stanley’s former chief Asia-Pacific economist.

In an interview with VOA this week Xie, who has long warned of asset and property bubbles in China, described what he thinks caused the current crisis, what China’s government has and has not been doing to deal with it, and the probable consequences for China and its people, as well as foreign investors.

This interview has been edited for clarity and brevity.

VOA: What caused this property bubble?

Andy Xie: Former Premier Wen Jiabao started this in 2006 when the currency was under appreciation. When a country develops, its currency undergoes appreciation pressure. People want more of your money because they think your currency is going up. If you don’t want it to go up, you just print more currency. That’s what the government did because it wanted Chinese exports to continue to be cheap. This is what happened to Taiwan in the 1980s, when its property market went through the roof. The right approach is to let the currency rise. If you don’t and you keep printing money, people will have a lot of money and they will pour it into the property market.

At the same time, the way for local governments in China to make money is from land sales to developers, which make up about 50% of their revenue. This has been going around for years.

VOA: How did China deal with the last property bubble?

Xie: During the last big downturn in 2008, after the U.S. crashed, the government pumped money like crazy to bring the property sector back. … Wen Jiabao forced banks to lend more and more. He was basically force-feeding the economy with debt. Afterwards, the way the property developers thought was, if you bring me down, I bring you down. They thought the government would not let them go down, because that meant the economy would crash. So, every time there was a downturn, they saw that as an opportunity to buy more land. Even after the pandemic happened, the market went up to a new high in 2021.

VOA: It’s been reported that the COVID lockdowns dampened demand in a slowing economy, and tougher government requirements for developers to access bank loans exposed long-underlying problems in the sector, where greedy developers kept borrowing to buy more land, without first finishing their projects. Besides these factors, what triggered this crisis?

Xie: The government started cracking down on shadow banking. That’s really what triggered this crisis. In the shadow banking system, the property developers would sell bonds to foreigners in offshore bond markets. They were going around and around to get money to fund the land purchases. … But they couldn’t pay back the foreigners, people who bought the property developers’ bonds in Hong Kong. When the banking regulators started cracking down on shadow banking, a lot of the money pulled out.

VOA: So, there were early signs of the property market trouble in offshore bond markets?

Xie: Rich people basically got a haircut already. Developers basically told them you have to extend the deadline. When I have money, I’ll pay you. When I don’t, tough luck. These buyers are mainly private banking clients who are rich and buy high-risk bond funds but have no rights in China. We don’t know how much money is owed to them, but it’s hundreds of billions of dollars.

VOA: Why isn’t the government bailing out the developers this time?

Xie: The developers have been on the ropes since 2022 when Evergrande stopped servicing its debt and they’ve been waiting for the government to give them money and the market was expecting the government to cave in.

But the government is not giving them money. Why? The banks won’t lend when they know the risk is too high.

If you bring the bubble back, you create a bigger problem for yourself tomorrow. This government is not facing political opposition, it wants to go on forever, so it’s thinking, why bring problems to yourself to make the bubble bigger and threaten yourself later? This is what a lot of analysts don’t understand. Politics has changed. Xi Jinping is the owner of all the problems in China and this is his calculation.

Domestically, the property developers owe 39 trillion renminbi in debt, according to a ratings agency. I think that is a low-ball estimate. I would expect a lot more.

Basically, whatever debt is due, they have no money to pay back.

VOA: So what measures is the government taking to deal with this massive problem?

Xie: The government's No. 1 priority is to tell developers, you have to finish the construction; the banks will lend you working capital to finish the projects, but the money cannot be used for anything else. So basically, these developers are bankrupt, but they’re still working.

Hundreds of billions of renminbi are being spent on this. What they have done is to protect the people who have prepaid for their new home. In China, it’s quite widespread, they pay first for construction.

The government is also trying to protect the small savers who have bought into high-yield wealth management products which the developers issued through banks that give you a 7% or 8% interest rate, higher than the 3% you would get if you just deposit money in the bank. A lot of these savers are not rich.

The government has also cut interest rates a little for buyers.

A lot of cities have also lifted sales restrictions, allowing people who don’t have household registration in the cities to buy a home there.

VOA: Will these measures rescue the sector and prevent its troubles from spreading to the rest of the economy?

Xie: They cannot change the tide because too much money is involved. Also, after the pandemic, the desire for speculation is down sharply. Instead, people are paying their debt early because they don’t think property prices will go up.

COVID had a big impact. Before, people were pumped up about getting rich, then COVID hit and you really know what the meaning of life is all about, you’re supposed to be happy with your family.

VOA: How will this impact China’s economy?

Xie: Economic downturn happens. International media is trying to portray this is the end of China. We see recessions all the time. And by the way, the Chinese economy is not contracting, it’s still growing and it’s growing by 5%. Who’s growing by that rate?

Economic downturn happens for a reason. You have overreached during boom time and need to be pushed back. Undesirable activity during boom time needs to be flushed out.

VOA: Isn’t this bad news for local governments, which have few types of taxes compared to Western countries, which have annual property taxes or retail tax?

Xie: They will have to look for other sources of income.

VOA: Is the habit of buying more property than one needs part of the problem?

Xie: Chinese people prefer the property market over the stock market. They see stocks as just a piece of paper. They prefer property because it’s something they can touch.

The total market capitalization of China’s stock markets is under 50% of its GDP, but at the peak in 2021, the value of residential property is as high as six times the GDP, which was $17 trillion last year.

On average, middle class Chinese families in cities like Shanghai own two properties, one to live in and one to invest in. The average amount of space for Chinese people is about 30 square meters per capita in urban areas. It’s at the U.S. level and much higher than Japan.

But if you build more and more property, eventually the market will be overwhelmed; there will be too much supply.

VOA: What will become of China’s property sector?

Xie: Property will become a normal thing. It will be what Xi Jinping said: "Housing is for living in, not for speculation." It will take 10 years to work out.

We had 7 trillion square meters under construction a couple of years ago. It’s come down 10% over the last two years so there’s still 6.3 trillion square meters.

In Xi’s speech in April as reported in a Communist Party newspaper, he said the government can’t condone unrealistic expectations.

A lot of people will lose money. … The government is just trying to make sure the little people don’t lose money.

VOA: In the end, will China be better or worse?

Xie: A lot of rich people are bitching because they made their money in property, not in the productive economy, so a lot of rich people are not really productive people. But we have a new generation of entrepreneurs, i.e., young engineers doing great things such as making rocket launchers, electric vehicles, radar technology, etc.

The most important thing for a country is not your top line GDP growth rate, it’s not what top financial guys feel, they are not important. What’s most important is how competitive you are, what kind of companies you’re creating and what kind of technology you’re creating.

Chinese people are hardworking, very clever, but many of them are into speculation. Twenty years ago, people asked me how China would collapse. I said it will happen if all Chinese officials become corrupt and all Chinese people become speculators.