Chinese efforts to portray their nation in Europe as a safe haven for investment appear to be falling flat.

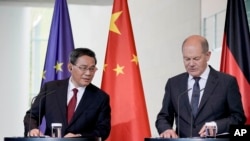

Chinese Premier Li Qiang was in Germany and France this week, promoting post-COVID China as a nation of open institutions operating in a market-oriented, world-class business environment governed by a legal framework that safeguards the rights and interests of foreign companies.

Yet a record-high 64% of surveyed China-based European companies reported that doing business in China became more difficult in 2022, according to the latest survey released by the European Union Chamber of Commerce in China.

The chamber’s survey found European companies’ confidence in the Chinese market is at a record low with 30% of respondents reporting that year-on-year revenue decreased in 2022, and one in 10 respondents reporting they have already shifted, or plan to shift, their Asia headquarters or business unit headquarters out of mainland China.

An American Chamber of Commerce survey released earlier this year showed that the investment enthusiasm of American businesses in China has cooled as well.

Jens Eskelund, president of the EU Chamber of Commerce in China, who is based in Beijing, said at a media briefing on June 21 that the most recent survey is a signal to Beijing that conversations about governance are needed.

"China has now for the majority of our companies dropped out as a top three destination for European investment,” he said. “If you look at the very near term, it's actually worse than that. We have 53% of our respondents, who tell us that they do not have any plan for increasing their investments during the present year.”

The pessimistic outlook stands in contrast to hopeful remarks delivered by Li at a banquet Wednesday evening in France.

“We hope that Chinese and French entrepreneurs will firmly support economic globalization … and will work together to maintain the stability and resilience of the supply chain between China, France and Europe,” he said.

The EU survey was conducted over five weeks in February and March and obtained 570 replies from senior executives of European business member companies, accounting for 46% of the total number of members. Among the respondents, 80% have lived in China for more than 10 years.

The survey shows 75% of the respondents have actively strengthened the flexibility of their supply chains in the past two years. Of this group, 12% said that their company has moved the relevant production line investment out of China, with many production lines gradually moving to countries in South or Southeast Asia.

As many as 59% of the respondents said that their operations were affected by Chinese politics last year, and they expect this to continue this year. In particular, 26% of the respondents believe that boycotts by Chinese consumers have affected their operations and brought challenges.

Of the respondents, 63% said market access was an issue, as are regulatory barriers. More than 60% of European companies said that if the Chinese market provides greater access opportunities, they will expand investment in China.

Eskelund said, “We have this whole ambiguity or lack of clarity of where is it actually that China is going, and I think what a lot of companies are perceiving is that there is a little bit of mixed messaging from the Chinese government.”

He said that at the 20th National Congress of the Communist Party of China last year, the CCP repeatedly emphasized national security and self-sufficiency, but at the National People's Congress in March, the government repeatedly declared that it would expand opening up and attract foreign investment.

The contradictory policy declarations make it difficult for European companies to figure out if China still welcomes foreign investment.

Darson Chiu, a research fellow at the Taiwan Institute of Economic Research in Taipei, told VOA Mandarin, "Many of (Chinese President) Xi Jinping’s policies are unfriendly to foreign businesses. As a result of US-China tensions and some of China’s strict controls on both foreign and domestic manufacturers, foreign investors have lost confidence."

When major multinationals urge their contract manufacturers, including Taiwanese-owned factories, to move their production lines out of China, that means foreign investors have insufficient confidence in the Chinese market, he said. He added that hopes for a rebound will depend on whether China can attract foreign business with new market demand.

Chiu also said that China is suffering from excessive inventory and high local government debt. These are the result of excessive investment in production capacity and fiscal measures taken to stimulate its economy following the draconian lockdowns dictated by anti-COVID-19 policies.

Although China lifted the lockdown in December, the economic recovery remains weak. Chiu said that judging from the double-digit year-on-year decline in China's export orders to Taiwan for five consecutive months from January to May this year, the Chinese economy has not yet started to rebound.

Wang Xin, president of the Charigo Center for International Economic Cooperation in Beijing, said that despite some difficulties, China's economic growth trajectory has not changed.

He said in an email to VOA Mandarin, "Amid the headwinds facing the world economy, European and American companies are unsure about the future outlook. They may have limited options. China's overall opening-up policy and goals have not and cannot be changed."

Wang said if European and American companies leave China, they will miss future opportunities. China will be introducing more policies to retain foreign businesses, he said, but in the meantime, “the best way to attract foreign investors is to maintain social stability and keep the opening policy unchanged.”

Adrianna Zhang contributed to this report