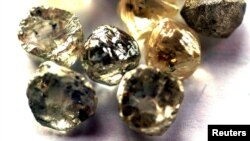

The government of Botswana said Monday it will buy a 24% stake in Belgian diamond company HB Antwerp. The deal comes amid uncertainty over Botswana’s long-standing sales agreement with industry giant De Beers.

Officially opening HB Antwerp’s cutting and polishing plant in Gaborone, President Mokgweetsi Masisi said Botswana must gain more from its diamond resources, for the “simple reason that the returns that come with having control to sell our diamonds with value addition, are much, much, higher than the returns on the sales of rough diamond stones.”

To that end, Masisi said that, “It is time for Botswana to participate not only in the process of extracting diamonds and selling them as rough stones without having processed them into value-added commodities across the diamond trade value chain.”

Last month, Masisi indicated his unhappiness with a 54-year-old sales deal with De Beers, in which Botswana is allocated 25% of rough diamonds mined under a joint venture. That deal is due to expire June 30.

Masisi said Monday that as part of Botswana’s bond with HB Antwerp, his government will make a significant investment in the three-year-old company. According to Masisi, both parties “have agreed to a strategic partnership whereby the government of Botswana will invest in HB by acquiring a 24% equity stake in HB Antwerp.”

“In addition,” Masisi said, “The government of Botswana, through its rough diamond trading company, Okavango Diamond Company (ODC), will supply rough diamonds to HB Botswana, which is HB Antwerp’s local subsidiary, for a period of five years, with all the value addition to take place in Botswana.”

No dollar figure for the total revenue expected to be generated from the 24% stake was given.

HB Antwerp co-founding director Rafael Papismedov, who was also at the ceremony, said the polishing and cutting factory opened in Gaborone is the world’s most advanced diamond facility.

According to Papsimedov, HB Antwerp will ensure Botswana gets a fair value for its precious stones, which are the main pillar for the southern African country’s economy.

“We are not here to nibble around the edges; we are all in,” Papsimedov emphasized. “Our success has come and will continue to come from our fearless willingness to challenge every aspect of the way things have been done to date and to recognize value where others overlooked it.”

Botswana’s Minister of Minerals and Energy Lefoko Moagi said that HB Antwerp will help the country extract more revenue from its stones through value addition.

“Today we break ground on many frontiers, as we seek to expand and grow meaningful participation in the entire diamond value chain,” said Moagi. “This investment is a step in the right direction, to ensure we increase our stake. In addition, we are breaking ground in our participation in the downstream, which currently, has not much footprint in the country.”

Botswana is the world’s second largest diamond producer by value, behind Russia.

The country enjoyed a surge in gem sales last year as buyers shunned stones mined in Russia due to Moscow’s invasion of Ukraine.