U.S. President Donald Trump has revived China's fears by once again calling it a currency manipulator, weeks after many felt the issue had been shelved. Trump reemphasized his stand last week, hours after Treasury Secretary Steven Mnuchin indicated China would not be singled out for adverse treatment on the currency issue.

"Well they, I think, they're grand champions at manipulation of currency. So I haven't held back," Trump told Reuters, adding, "We'll see what happens."

The U.S. Treasury Department is expected to make a call on the issue on April 15. But Mnuchin may have to disclose the administration's plans at the G20 finance ministers' meeting March 17-18 in Bonn.

Many economists believe the Chinese Yuan is not being deliberately devalued as in the past. The International Monetary Fund said last year the Chinese currency's value was broadly in line with its economic fundamentals.

"There is no evidence of currency manipulation in recent times, beyond the occasional buying and selling of foreign exchange to stabilize volatilities, which all countries, rich and poor, do," said Kaushik Basu, Professor at Cornell University and a former Chief Economist of the World Bank. "I hope the U.S. would not declare China a currency manipulator, which would not be right and would also unleash destabilizing forces in foreign exchange markets the world over."

In normal practice, the U.S. Treasury would apply three criteria to determine if China deserves the label of a currency manipulator when it meets on April 15.

"If the Treasury Department adheres to its three criteria, it won’t [declare China as a manipulator], since China currently only meets one of the three criteria. It could decide, though, to ignore those criteria," said Scott Kennedy, director of the project on Chinese business and political economy at the Washington-based Center for Strategic and International Studies. "The ultimate decision will turn on broader U.S. policy toward China, which is still being decided."

This is bad timing for China where foreign direct investments (FDI) reversed, falling 9.2 percent in January. The slide came after FDI grew 3.9 percent in November and 4.1 percent in December. Figures for February, which will be available after 8-10 days, would explain more clearly if the slide is a trend or just a monthly variation.

"The drop in FDI seen in China recently may well be in response to Trump’s threats to build barriers. But there are other factors too. There has been a bunched up profit repatriation from China by China’s foreign investors in recent times, which contributed to the decline in net FDI," said Basu.

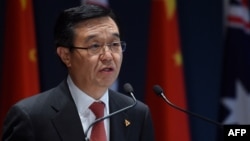

Minister's removal

Beijing suddenly replaced Minister for Commerce Gao Hucheng on Friday soon after the slippage in FDI numbers and Trump reiterating his threat of declaring China a currency manipulator.

Before his removal, Gao told a press conference, "We never use one month's figure to summarize a long-term trend, and an early Spring Festival last month was another factor to affect the country's monthly FDI volume," said Gao, adding, "The FDI in any country will come and go with the development of the economy and changing industrial structure."

China's FDI fell 13 percent year on year in 2016.

"I don’t think such short-term volatility in FDI data can meaningfully be attributed to any Trump effect. It is most likely merely noise in the data caused by a lot of random business decisions," said Jacob Kirkegaard, economist with the Peterson Institute of International Affairs.

Analysts are divided on whether President Xi Jinping decided to replace Gao as part of Beijing's preparations to deal with economic challenges expected to come from the Trump administration, or merely because he was close to the retirement age stipulated by the Communist Party.

"It suggests the commerce minister has reached retirement age and Xi is starting to consider the composition of the Cabinet for his second term," said Kennedy. "Zhong Shan [the new commerce minister] may or may not stay on."

Investors pulling out

The American Chamber of Commerce in China said 25 percent of U.S. companies in China have moved their operations to other countries or are planning to do so.

Kennedy said this is a result of worsening investment conditions in China and the application of tighter capital controls.

"I think as Chinese growth slows and financial risks increase, combined with a more discriminatory treatment of foreign investors in China, many foreign investors will rightly ask if their investments in China continue to be justified by the 'Ooh, it’s a billion people so we gotta be there' factor," said Kirkegaard. "... If foreign businesses don’t make much money in China they will stop coming."