The global economy has picked up and prospects for the next few months are the best in a long time.

But the recovery is maturing and faces risks from populist rejection of free trade and from high debt that could burden consumers and companies as interest rates rise.

Those were key takeaways from a review of the global economy released Sunday by the Bank for International Settlements, an international organization for central banks based in Basel, Switzerland.

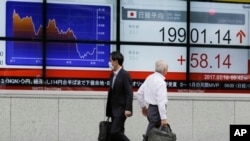

The report said that "the global economy's performance has improved considerably and that its near-term prospects appear the best in a long time." Global growth should reach 3.5 percent this year, according to a summary of forecasts, not quite what it was before the Great Recession but in line with long-term averages. Meanwhile, financial markets for stocks and bonds have been unusually buoyant and steady.

On top of that, forecasts by governments and international organizations as well as by private analysts point to "further gradual improvement" in coming months.

Key risks include a possible weakening of consumer spending across different economies. So far, the recovery has been largely fueled by people being willing and able to spend more. But that trend could fall victim to higher levels of debt as interest rates rise in some countries and as the amount people need to spend to service their debts takes a bigger chunk of income.

Countries that were slammed by collapsing real estate markets during the Great Recession seem less vulnerable now, such as the United States, the U.K., and Spain. But debt burdens are more worrisome in a range of other countries mentioned in the report, including China, Australia and Norway.

Another risk comes from weak business investment, typically the second stage of recovery after consumers start spending more; yet that kind of spending has lagged its pre-recession levels for reasons that aren't always clear to economists.

The BIS urged governments around the world to take advantage of the economic recovery as an opportunity to make growth more resistant to trouble by implementing pro-business and pro-growth measures.

In particular, the report warned against a backlash against globalization, saying that trade and interconnected financial markets had led to higher standards of living and lifted large parts of the world's population out of poverty. It called for domestic policies to address inequality and lost jobs, saying that changing technology was often to blame, not free trade. "Attempts to roll back globalization would be the wrong response to these challenges," it said.