Beijing is using state subsidies to build up its rare earths industry and plans to use it as a geopolitical weapon against the West, according to a new report by U.S. researchers.

China’s dominance in mining the metals and ore that are critical to high-tech manufacturing has long been a focus of American lawmakers concerned over rare earths supply.

But the new report published Monday by an American consulting firm, Horizon Advisory, concludes that China values the industry for its potential for geopolitical dominance rather than its commercial value.

“They’re not concerned with economic return in many of these cases,” Horizon founder Nathan Picarsic told the Wall Street Journal. “They see controlling this type of [industry] as a path to win without fighting.” His consulting firm focuses on the implications of China’s competitive approach to geopolitics, according to the Foundation for the Defense of Democracies where he is a senior fellow.

According to Horizon, a 2019 Chinese government-funded report stated, “China will not rule out using rare earth experts as leverage” when dealing with the then-escalating U.S.-China trade war.

Chinese officials have not yet commented on the allegation, but in the past, officials have defended the country’s dominance of the rare earths mining industry by saying they are a reliable commercial partner in the global supply chain.

Rare earths needed

China provides the largest variety of minerals to the United States. Rare earths are just one category. Rare earths are used in everything from smartphones to electric car motors, as well as military jet engines, satellites and lasers, according to Reuters. Extracting them is expensive in part because they are difficult to mine.

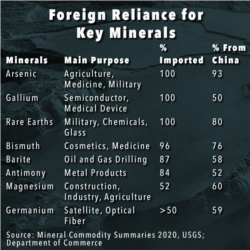

According to the 2020 Mineral Commodity Summaries by the U.S. Geological Survey (USGS), at least eight key minerals that the U.S. needs are marked as dependent on China. More than half of these mineral products are imported, with Chinese products accounting for at least 50% of the imports.

Moreover, the desire for clean energy, especially electric vehicles, is driving the demand for mineral supplies.

According to the International Energy Agency, clean energy technologies generally require more minerals than fossil fuel-based counterparts.

“An electric car uses five times as much minerals as a conventional car, and an onshore wind plant requires eight times as much mineral as a gas-fired plant of the same capacity,” the agency said in a recent report.

In a recent Senate hearing on U.S. mineral supplies, Nedal Nassar, chief of materials flow analysis with the federal United States Geological Survey (USGS), said that the dependence on China might have a direct impact on American consumers.

Using tungsten, a key mineral used in auto manufacturing as an example, Nassar said that if it were to be cut off, the impact could be felt throughout the length of the auto supply chain.

“You can imagine the impact throughout the manufacturing sector and then ultimately to the U.S. consumer. So that's going to increase prices, consumer prices,” Nassar said.

According to a report released by the U.S. Department of Commerce in 2019, if China or Russia were to stop exports to the United States and its allies for a prolonged period – similar to China’s rare earths embargo in 2010 – an extended supply disruption could cause significant shocks throughout U.S. and foreign critical mineral supply chains.

Congressional efforts

Senator Joe Manchin (D-WV), the ranking member of the Senate Committee on Energy and Natural Resources, said at a hearing earlier this month that the U.S. needs to focus on investing in innovative mining and mineral processing practices, developing viable substitutes for critical materials that can be found inside the U.S., and implementing smart policies for recycling critical materials.

“All these things can reduce our reliance on foreign imports while creating jobs right here in the United States,” Manchin said.

There have been several efforts in Congress to push for production of minerals in the United States, including bills aimed at providing tax relief for the rare earths industry, promoting domestic rare earths mining and developing new recycling technology.

Senator Ted Cruz, a Texas Republican, introduced legislation last month to help revive the U.S. rare earths industry with tax breaks for mine developers and manufacturers who buy their products.

Also last month, U.S. Senators Lisa Murkowski, R-Alaska, Joe Manchin, D-W.Va., Martha McSally, R-Ariz., and Dan Sullivan, R-Alaska, introduced bipartisan legislation, the American Mineral Security Act, that takes a comprehensive approach to begin reducing the United States’ dependence on foreign minerals. “Our nation’s mineral security is a significant, urgent, and often ignored challenge, said Murkowski, the chairperson when introducing the legislation. “Our reliance on China and other nations for critical minerals costs us jobs, weakens our economic competitiveness, and leaves us at a geopolitical disadvantage.”

Lin Yang contributed to this report that originated on VOA Mandarin.