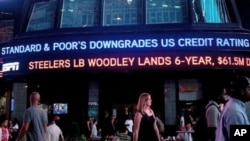

World financial markets suffered more losses Monday, because of a U.S. credit rating downgrade, and continued European debt concerns and fears of a global economic slowdown. The firm that cut America’s AAA credit rating, Standard & Poor’s, says the United States could regain its top-tier status, but is unlikely to do so for years to come.

International credit rating agency Standard & Poor's says its decision to drop the status of U.S. government one level to "AA+" was based on an analysis of the same five "pillars" in the sovereign rating framework used to determine the creditworthiness of the 126 countries that S&P evaluates.

|

S&P lists 5 pillars in its Sovereign Rating Framework as: |

|

In a conference call, Standard & Poor’s executives sought to provide additional insight into Friday’s bombshell announcement, which the firm had hinted for weeks could be forthcoming, but which nevertheless came as a bitter pill to many in the United States and across the globe.

S&P Managing Director John Chambers said the credit rating downgrade stemmed not only from runaway U.S. deficits and national debt, but also the expectation that America’s debt burden will grow heavier in the future. In particular, Chambers pointed to Washington’s inability to overcome political obstacles and enact aggressive fiscal reforms.

“We do not foresee under anything but the most optimistic forecasts will the debt-to-GDP [gross domestic product] ratio of the United States government stabilize in the forecast horizon,” he said.

Chambers acknowledged that there are other countries, such as France, with even-grimmer debt situations than the United States that are retaining their AAA credit rating. But he noted that, unlike the United States, France has already undertaken significant reforms that are expected to halt and eventually reverse its growing debt burden as a share of economic output.

S&P executives said five countries, including Canada, Sweden and Australia, managed to regain a AAA rating after falling to AA+, as the United States did last week. But they noted that the quickest rating recovery took nine years to materialize, and came after enacting significant reforms to improve finances and boost economic output.

David Beers, who heads Standard and Poor’s sovereign credit rating unit, says the United States has yet to demonstrate its capacity and commitment to change.

“Given the nature of the debate currently in the country and the polarization of views around fiscal policy right now, we do not see anything immediately on the horizon that would make this the most likely scenario - an upgrade back to AAA again,” Beers said.

The S&P downgrade of the United States can be seen as political commentary from a financial perspective, according to the head of California-based PIMCO global investment company, Mohamed El-Erian, who spoke on Bloomberg Television.

“The S&P downgrade is not really about the ability of the U.S. to meet its [debt] payments," El-Erian explained. "No one doubts the ability of the U.S. to meet its payments. It is about the ability of its policymakers to get their arms around the problems, and put the country back on the path of growth, jobs, and prosperity. And until they do that, we [the United States] risk further downgrades.”

El-Erian says the S&P downgrade will have significant psychological and economic effects for the world economy.

“This is a further hit to business confidence and to household confidence," he noted. "It comes at a fragile time for the economy, and it is not a surprise that most analysts are busily revising down their growth estimates, and there has been so much talk over the weekend of recession.”

Late last month, the Commerce Department said the U.S. economy expanded at an annual rate of 1.3 percent during the second quarter of the year - an anemic pace that, even before the S&P downgrade, had some economists worried about the possibility of a stalling economic recovery.

Related video report by Jim Randle