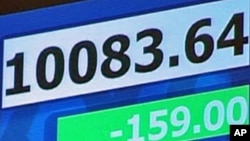

Stocks and the euro currency had a tumultuous day Wednesday, with markets falling over the news of new German measures to curb market speculation but the euro bouncing back after hitting a four-year low. Our corespondent has the latest installment on a rocky financial month for Europe.

Stocks fell sharply on Wednesday after Germany introduced a surprise measure - a ban against what is known as "naked" short selling of shares in its top financial institutions. The term refers to a financial transaction in which a person sells an asset that he neither owns nor borrows. The mechanism has been blamed for exacerbating the falls in stock markets -- and in effect deepening Europe's financial headaches.

The German ban took effect on Wednesday and lasts until March 2011. It comes amid a larger crisis hitting the 16-nation eurozone sharing the European currency that was triggered by Greece's huge public deficit and debt.

Speaking to parliament after the ban was introduced, German Chancellor Angela Merkel said tougher financial regulation was critical to defend the eurozone.

Merkel said that if the euro fails, then Europe fails. But, she added, if governments take measures to anticipate and prevent the danger, then both the euro and Europe will be stronger than ever.

But even as stock markets fell at the news, the euro rebounded after hitting its lowest point against the dollar in four years. It came as the European Commission, the European Union's executive arm, urged coordinated action on implementing financial trading restrictions.

These separate announcements are designed to fight against fears that the Greek financial crisis could spread elsewhere. The fears remain despite a newly created, last ditch financial package available to troubled economies by European Union and the International Monetary Fund that is worth about a trillion dollars.

Meanwhile, Greece made an $11 billion repayment to avoid defaulting on its debt using billions of dollars borrowed from its European partners. Greece's prime minister George Papandreou warned, however, that failure to control financial speculators could trigger international conflict.

Stocks Fall In Europe After German Regulations Announced

- By Lisa Bryant