Nicole Watson shares a rented apartment in New York’s Brooklyn neighborhood with little hope of jumping into the city’s pricey real estate market in the near future.

At 38, Watson has nearly six figures in student loan. “It’s enough to buy a high-end Mercedes Benz,” she says jokingly.

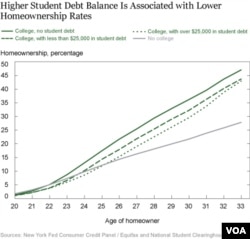

Fewer people with student loan debt are able to pursue homeownership, according to a recent study by the Federal Reserve Bank of New York.

“Student debt has increased more than fivefold over the past 14 years,” said bank president and CEO William Dudley, adding that delinquency rates for these debts remain high.

Students at four-year colleges graduate with an average of $37,000 in student loan debt, a number reflective of rising tuition costs.

“Our analysis reveals that those with significant student debt are much less likely to own a home at any given age than those who completed their education with little or no student debt,” said Dudley.

He says there are many factors resulting in a high debt burden and repayment rates including high college dropout rates and evidence showing that graduates from some colleges have had trouble finding good-paying jobs.

“I was not a competitive candidate in my chosen field with just a Bachelor’s degree,” says Watson who works in the New York-based fashion and beauty industry. “So I decided to get my Masters [degree].”

Like many Americans, this was done with student loans.

“I grew up at a time when parents stressed the importance of having a four-year college education,” says Watson. “They believed that once you get to college, all your problems were solved. For them, that was the answer.”

But Watson, like many first-generation college students, was left trying to figure out the financial aspect of higher education on her own.

“My parents could not afford my tuition. So I was 19, trying to figure out how to pay for school.”

She says this inexperience in dealing with financial aid and student loans led to some poor decisions, including taking out an unsubsidized loan.

Unlike federally subsidized loans which don’t accrue interest until six months after graduation, the interest on unsubsidized loans begins to accrue as soon as the funds are dispersed and can be added to your principal loan balance if not paid immediately.

“I’ve been paying that loan for over 15 years,” says Watson. “Once that’s paid off, I won’t feel like the rest of my student loan debt is so insurmountable.”

The New York Fed chief said that continued increases in college costs and student debt “could inhibit higher education’s ability to serve as an important engine of upward income mobility.”

According to the Federal Reserve report, homeownership and housing equity are the “principal forms of wealth for most households.”

It says the increased reliance on student debt may have important implications for the housing market, economic growth and wealth distribution in the U.S.

How will you finance your college education?

Please leave a comment here, and visit us on Facebook, Twitter, Instagram and LinkedIn, tha