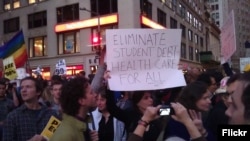

Student Union

Third of Student Debt Owned by Only 6% of Borrowers

One-third of outstanding U.S. student loan debt is owned by only 6% of all student loan borrowers, according to a new report.

The public policy nonprofit Brookings Institution released a report this week clarifying where all of that $1.5 trillion student debt comes and goes.

"A very small fraction of all student loan borrowers have very large loans. Six percent of borrowers owe more than $100,000 in debt, with 2% owing more than $200,000," the report by Brookings' Kadija Yilla and David Wessel found. "This 6% owes one-third of the outstanding $1.5 trillion of debt.

"At the other extreme, 18% of borrowers owe less than $5,000 in student loan debt. They collectively owe 1% of the debt outstanding," the report stated.

About one-quarter of those with student loans borrowed for graduate school, Brookings said, but that one-quarter owns about half of all outstanding student loan debt.

"While only a small share of households with student debt have a graduate degree, loans associated with graduate degrees account for 50% of the total outstanding student loan debt," the report said. Households with student debt headed by someone without a bachelor’s degree account for only one-quarter of total outstanding debt.

And those who owe the most are not the ones defaulting on debt, the Brookings report said.

Brookings said borrowers with graduate degrees who own half of all student debt are the least likely to default. Who has higher default rates? Those who attend for-profit universities, like DeVry and the University of Phoenix.

In February 2018, U.S. President Donald Trump was required to pay $25 million to settle class-action lawsuits accusing Trump University of fraud after failing to deliver on promises to teach students how to succeed in the real estate sector.

"Forty percent of borrowers from for-profit, two-year programs default on their loans within five years," the report said. Just under one-third of borrowers who attended for-profit four-year programs "defaulted in this same timeframe."

Among students who borrowed to attend public community colleges, about 25% default within five years of entering repayment.

Defaults are much less frequent among those who borrowed to go to public or private nonprofit four-year schools.

Student debt is not all about tuition. In some cases, room and board, books, transportation and other living expenses cost well above tuition.

"Many students borrow to not only cover their tuition and fees but also to get cash to finance the cost of living while they are in school," Brookings reported.

Some public schools offer students "tuition free" financial aid. But that doesn't include the dorm or rental housing, or food. For students at public universities and colleges who pay no tuition, 22% borrow $30,000 or more. The average student borrows $24,000, Brookings said, based on an Urban Institute analysis conducted using the National Postsecondary Student Aid Study.

And what about all those young college students receiving bachelor's degrees from four-year colleges and universities? They graduate with little to no debt, Brookings said.

"Thirty percent of all bachelor’s degree recipients graduate with no debt," Brookings reports. "Another 23% graduate with less than $20,000 in loans."

Fewer than 20% of all borrowers owed more than $40,000. Only 12% of those who attended four-year public colleges owed more than $40,000.

See all News Updates of the Day

- By VOA News

Competition grows for international students eyeing Yale

It’s tough to gain admission to Yale University, and it’s getting even tougher for international students as standout students from around the world set their sights on Yale.

The Yale Dale News, the campus newspaper, takes a look at the situation here.

- By VOA News

Student from Ethiopia says Whitman College culture made it easy to settle in

Ruth Chane, a computer science major from Ethiopia, writes about her experiences settling into student life at Whitman College in the U.S. state of Washington.

"The community at Whitman College made sure I felt welcomed even before I stepped foot on campus," she says.

- By VOA News

Claremont Colleges student gets a shock when she heads home to Shanghai

In The Student Life, the student newspaper for the Claremont Colleges, a consortium of five liberal art colleges and two graduate schools in Claremont, California, student Rochelle Lu writes about readjusting to her Shanghai home after spending a semester in the United States.

- By VOA News

Cedarville University aims to ease transition for international students

Cedarville University in the U.S. state of Ohio says it’s got more than 140 international students representing 44 countries.

Here, the school interviews Jonathan Sutton, director of international student services. He talks about his job and the opportunities for international students on campus.

- By VOA News

Morehouse College offers prospective students tips on applying and thriving

Morehouse College, a private, historically Black liberal arts college in the U.S. state of Georgia, offers a guide for international students interested in attending the school.

Among the tips to apply and thrive at Morehouse:

- Take advantage of the school’s orientation program

- Turn to the school’s Center for Academic Success for tutoring, support and more

- Immerse yourself in campus life via clubs and societies

- By Reuters

US reviews Columbia University contracts, grants over antisemitism allegations

The administration of President Donald Trump said on Monday it will review Columbia University's federal contracts and grants over allegations of antisemitism, which it says the educational institution has shown inaction in tackling.

Rights advocates note rising antisemitism, Islamophobia and anti-Arab bias since U.S. ally Israel's devastating military assault on Gaza began after Palestinian Hamas militants' deadly October 2023 attack.

The Justice Department said a month ago it formed a task force to fight antisemitism. The U.S. Departments of Health and Education and the General Services Administration jointly made the review announcement on Monday.

"The Federal Government's Task Force to Combat Anti-Semitism is considering Stop Work Orders for $51.4 million in contracts between Columbia University and the Federal Government," the joint statement said.

The agencies said no contracting actions had been taken yet.

"The task force will also conduct a comprehensive review of the more than $5 billion in federal grant commitments to Columbia University."

The agencies did not respond to requests for comment on whether there were similar reviews over allegations of Islamophobia and anti-Arab bias.

Columbia had no immediate comment. It previously said it made efforts to tackle antisemitism.

College protests

Trump has signed an executive order to combat antisemitism and pledged to deport non-citizen college students and others who took part in pro-Palestinian protests.

Columbia was at the center of college protests in which demonstrators demanded an end to U.S. support for Israel due to the humanitarian crisis caused by Israel's assault on Gaza. There were allegations of antisemitism and Islamophobia in protests and counter-protests.

During last summer's demonstrations around the country, classes were canceled, some university administrators resigned and student protesters were suspended and arrested.

While the intensity of protests has decreased in recent months, there were some demonstrations last week in New York after the expulsion of two students at Columbia University-affiliated Barnard College and after New York Governor Kathy Hochul ordered the removal of a Palestinian studies job listing at Hunter College.

A third student at Barnard College has since been expelled, this one related to the occupation of the Hamilton Hall building at Columbia last year.

Canada’s immigration overhaul signals global shift in student migration

From Europe to North America, nations are tightening their immigration policies. Now Canada, long seen as one of the world's most welcoming nations, has introduced sweeping changes affecting international students. The reforms highlight a growing global trend toward more restrictive immigration policies. Arzouma Kompaore reports from Calgary.

Trump administration opens antisemitism inquiries at 5 colleges, including Columbia and Berkeley

The Trump administration is opening new investigations into allegations of antisemitism at five U.S. universities including Columbia and the University of California, Berkeley, the Education Department announced Monday.

It's part of President Donald Trump's promise to take a tougher stance against campus antisemitism and deal out harsher penalties than the Biden administration, which settled a flurry of cases with universities in its final weeks. It comes the same day the Justice Department announced a new task force to root out antisemitism on college campuses.

In an order signed last week, Trump called for aggressive action to fight anti-Jewish bias on campuses, including the deportation of foreign students who have participated in pro-Palestinian protests.

Along with Columbia and Berkeley, the department is now investigating the University of Minnesota, Northwestern University and Portland State University. The cases were opened using the department's power to launch its own civil rights reviews, unlike the majority of investigations, which stem from complaints.

Messages seeking comment were left with all five universities.

A statement from the Education Department criticized colleges for tolerating antisemitism after Hamas' Oct. 7, 2023, attack on Israel and a wave of pro-Palestinian protests that followed. It also criticized the Biden administration for negotiating "toothless" resolutions that failed to hold schools accountable.

"Today, the Department is putting universities, colleges, and K-12 schools on notice: this administration will not tolerate continued institutional indifference to the wellbeing of Jewish students on American campuses," said Craig Trainor, the agency's acting assistant secretary for civil rights.

The department didn't provide details about the inquiries or how it decided which schools are being targeted. Presidents of Columbia and Northwestern were among those called to testify on Capitol Hill last year as Republicans sought accountability for allegations of antisemitism. The hearings contributed to the resignation of multiple university presidents, including Columbia's Minouche Shafik.

An October report from House Republicans accused Columbia of failing to punish pro-Palestinian students who took over a campus building, and it called Northwestern's negotiations with student protesters a "stunning capitulation."

House Republicans applauded the new investigations. Representative Tim Walberg, chair of the Education and Workforce Committee, said he was "glad that we finally have an administration who is taking action to protect Jewish students."

Trump's order also calls for a full review of antisemitism complaints filed with the Education Department since Oct. 7, 2023, including pending and resolved cases from the Biden administration. It encourages the Justice Department to take action to enforce civil rights laws.

Last week's order drew backlash from civil rights groups who said it violated First Amendment rights that protect political speech.

The new task force announced Monday includes the Justice and Education departments along with Health and Human Services.

"The Department takes seriously our responsibility to eradicate this hatred wherever it is found," said Leo Terrell, assistant attorney general for civil rights. "The Task Force to Combat Anti-Semitism is the first step in giving life to President Trump's renewed commitment to ending anti-Semitism in our schools."

- By VOA News

STEM, business top subjects for international students

The Times of India breaks down the most popular subjects for international students to study in the U.S.

STEM and business lead the pack. Read the full story here. (January 2025)

- By VOA News

Safety and visa difficulties among misconceptions about US colleges

U.S. News & World report addresses some of the misconceptions about U.S. colleges and universities, including the difficulty of getting a visa.

Read the full story here. (January 2025)

- By VOA News

Work opportunities help draw international students to US schools

US News & World Report details the three top factors in foreign students' decision to study in the U.S. They include research opportunities and the reputation of U.S. degrees. Read the full story here. (December 2024)

- By VOA News

British student talks about her culture shock in Ohio

A British student who did a year abroad at Bowling Green State University in Ohio talks about adjusting to life in America in a TikTok video, Newsweek magazine reports.

Among the biggest surprises? Portion sizes, jaywalking laws and dorm room beds.

Read the full story here. (December 2024)

- By VOA News

Harvard's Chan School tells international students what to expect

Harvard's T.H. Chan School of Public Health reaches out to international students by detailing the international student experience at the school.

Learn more about housing, life in Boston and more here.

- By Reuters

China unveils plan to build 'strong education nation' by 2035

China issued its first national action plan to build a "strong education nation" by 2035, which it said would help coordinate its education development, improve efficiencies in innovation and build a "strong country."

The plan, issued Sunday by the Communist Party's central committee and the State Council, aims to establish a "high quality education system" with accessibility and quality "among the best in the world."

The announcement was made after data on Friday showed China's population fell for a third consecutive year in 2024, with the number of deaths outpacing a slight increase in births, and experts cautioning that the downturn will worsen in the coming years.

High childcare and education costs have been a key factor for many young Chinese opting out of having children, at a time when many face uncertainty over their job prospects amid sluggish economic growth.

"By 2035, an education power will be built," the official Xinhua news agency said, adding that China would explore gradually expanding the scope of free education, increase "high-quality" undergraduate enrolment, expand postgraduate education, and raise the proportion of doctoral students.

The plan aims to promote "healthy growth and all-round development of students," making sure primary and secondary school students have at least two hours of physical activity daily, to effectively control the myopia, or nearsightedness, and obesity rates.

"Popularizing" mental health education and establishing a national student mental health monitoring and early warning system would also be implemented, it said.

It also aims to narrow the gap between urban and rural areas to improve the operating conditions of small-scale rural schools and improve the care system for children with disabilities and those belonging to agricultural migrant populations.

The plan also aims to steadily increase the supply of kindergarten places and the accessibility of preschool education.

- By VOA News

A look at financial aid options for international graduate students in US

The Open Notebook, a site focusing on educating journalists who cover science, has complied a list of U.S. graduate program financial aid information for international students.