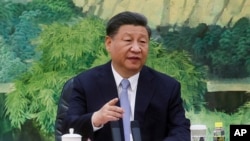

Chinese President Xi Jinping will be in South Africa next week for a major summit as well as an official state visit, at a time of increasing South African concern about persistent trade imbalances in the countries' relationship, as well as worries about China’s domestic economy.

Naledi Pandor, South African minister for international relations and cooperation, said last week that in 2022, trade with fellow BRICS nations – Brazil, Russia, India, China – accounted for 21%% of South Africa’s global trade, or $43 billion (830 billion rand).

China, which is South Africa’s biggest individual trading partner, accounts for the lion’s share of the BRICS group’s trade with South Africa, Stavros Nicolaou, head of the South Africa BRICS Business Council, told VOA this week – 68%, followed by India at 27%. Russia’s and Brazil’s trade levels with South Africa are much smaller.

China is also Africa’s largest trading partner overall, with $282 billion worth of trade with the continent in 2022. The theme of this year’s summit, held in South Africa’s economic hub, Johannesburg, is "BRICS and Africa: Partnership for Mutually Accelerated Growth, Sustainable Development and Inclusive Multilateralism."

President Cyril Ramaphosa has invited numerous other African heads of state, some of whom – like the continent’s biggest economy, Nigeria – have expressed interest in joining the bloc.

The fact that Xi is adding a state visit to the BRICS trip “is a very, very powerful message that he’s sending to other African countries: that China is back after a three-year COVID-induced freeze,” said Paul Nantulya, a research associate at the Africa Center for Strategic Studies.

“The fact that Xi Jinping will visit the continent before [U.S. President] Joe Biden — because there are rumors that Joe Biden will visit Africa in person — that is a diplomatic coup for China,” he told VOA.

Trade imbalance

One problem some African countries have pointed to is the significant trade imbalance with China that still exists. Pandor is among those who say this needs to be addressed.

“South Africa continues to have a trade deficit in its overall trade with BRICS countries. The urgent need for trade diversification, as primary products continue to be the largest share of exports, therefore remains,” she told reporters last week.

Nicolaou echoed this, noting that in 2022, South Africa had a $10.9 billion deficit with China.

South Africa's main exports to China include minerals, precious metals and agriculture. Imports from China are dominated by machinery.

“So, we run a trade deficit with all four BRICS countries as South Africa. Now, there’s no problem running a trade deficit, but if you analyze the constituent makeup of that trade deficit, there’s very clearly a pattern where we are exporting raw materials and importing finished products,” Nicolaou told VOA in an interview.

“Therein lies the concern, but therein lies the opportunity as well,” he continued, noting that some of the groundwork was laid last week on a pre-summit visit to the country by Chinese Commerce Minister Wang Wentao.

After Wang’s meeting with South African counterpart Ebrahim Patel, the two signed a deal for Chinese companies to buy products worth $2 billion from South Africa. South African companies that signed included mining conglomerates Anglo-America and Glencore.

“Our levels of trade are very significant; however, the composition of our trade needs to change. It has been focused principally on raw materials. We now need to shift to greater levels of industrial exports of manufactured goods,” Patel said at the meeting.

Asked if South Africa can move from exporting mainly raw materials to finished products, Nicolaou was circumspect.

“We obviously face domestic economic headwinds in South Africa at the moment, so there are constraints ... in terms of energy and infrastructure et cetera. So I think we’ve got to look at those products that allow us an immediate export return given the constraints, but we also need to plan for the future,” he said.

China’s domestic economic woes

China itself has been facing domestic problems – rising unemployment, prices and wages falling, a property market slowdown and deflation worries – and has also been seen to be downscaling its international Belt and Road infrastructure initiative, favoring smaller projects.

Asked whether China’s own economic downturn could impact its international image as a trading heavyweight, Nicolaou said, “I think you’re going to get these differing economic growth patterns. … That’s why I don’t think we’re banking on just one partner or just one geography here.”

For his part, Mikatekiso Kubayi, a researcher at the Institute for Global Dialogue at the University of South Africa, said he didn't think China’s own economic downturn would have much of an impact on trade relations.

“China, just like any other country, will pursue trade deals and such relationships, you know, regardless [of] its position domestically, in the same way that the United States does the same thing, despite an economic downturn,” he said.

“You trade whether your economy’s on an upswing, you trade whether your economy’s on a downswing. Trade is a permanent fixture.”

But African exports to China reportedly fell in the first six months of this year. And some traders have said developments in China's real estate market affect the price of South African exports like iron ore.

Several high-ranking U.S. officials were in South Africa and elsewhere on the continent in the past week for trade talks.

The Chinese Embassy in Pretoria did not respond to a request for comment on either the domestic downturn or the trade imbalance between China and South Africa.