U.S. consumer spending rebounded by the most on record in May, but the gains are not likely to be sustainable, with income dropping and expected to decline further as millions lose their unemployment checks starting next month.

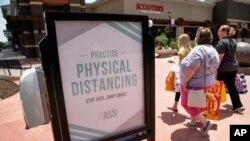

The report from the Commerce Department on Friday added to increases in homebuilding permits, industrial production and orders for manufactured goods in suggesting the economy was turning the corner after the stringent measures to control the COVID-19 pandemic tipped it into recession in February.

But the nascent recovery is under threat from a surge in confirmed coronavirus cases in many parts of the country, including highly populated California, Texas and Florida.

"There are still huge pitfalls ahead for the economy," said Gus Faucher, chief economist at PNC Financial in Pittsburgh, Pennsylvania. "Personal income and consumer spending are likely to take huge hits over the next couple of months unless Congress provides more fiscal stimulus."

The Commerce Department said consumer spending, which accounts for more than two-thirds of U.S. economic activity, jumped 8.2% last month. That was largest increase since the government started tracking the series in 1959. Consumer spending tumbled by a historic 12.6% in April.

Economists polled by Reuters had forecast spending rising 9.0% in May. The surge in spending last month reflected the reopening of many businesses after being shut in mid-March to slow the spread of respiratory illness.

Consumers stepped up purchases of motor vehicles and recreational goods. They also boosted spending on health care, and at restaurants, hotels and motels.

But personal income dropped 4.2%, the most since January 2013, after surging by a record 10.8% in April when the government handed out one-time $1,200 checks to millions of people and boosted unemployment benefits to cushion against the COVID-19 hardship. The payments are part of a historic fiscal package worth nearly $3 trillion.

Stocks on Wall Street were trading lower, pressured by the rising coronavirus infections and the Federal Reserve's move to cap big bank dividend payments and bar share repurchases until at least the fourth quarter. The dollar was steady against a basket of currencies. U.S. Treasury prices rose.

Government payments

The drop in income last month reflected a decrease in government welfare payments related to the pandemic.

The government will stop paying an additional $600 per week in unemployment benefits on July 31. Economists estimate about 26 million people, two-thirds of whom do not qualify for the regular 26-week state unemployment insurance benefits, would be left without income.

About 30.6 million people, roughly a fifth of the labor force, were collecting unemployment checks in the first week of June. Government transfers to households totaled $1.1 trillion last month compared to $3 trillion in April.

Wages increased 2.7% after dropping 7.6% in April. But with record unemployment, last month's gains will likely fizzle.

Consumer spending in May was funded from savings, which decreased by $1.9 trillion. The saving rate dropped to a still-high 23.2% from a record 32.2% in April. Historically high savings could support spending. Economists, however, caution that uncertainty amid soaring COVID-19 infections could prompt consumers to hunker down and conserve their income.

Inflation weak

Inflation remained weak in May, with food prices moderating and the cost of energy goods and services declining for a fifth straight month. The personal consumption expenditures (PCE) price index excluding the volatile food and energy components edged up 0.1% after falling 0.4% in April.

In the 12 months through May, the so-called core PCE price index rose 1.0%, matching April's gain. The core PCE index is the Federal Reserve's preferred inflation measure. The U.S. central bank has a 2% inflation target.

When adjusted for inflation consumer spending surged a record 8.1% in May after tumbling 12.2% in April. Still the so-called real consumer spending remained 11.2% below its pre-pandemic level.

That kept intact economists' expectations for the sharpest plunge in consumer spending and economic growth in the second quarter since the Great Depression.

Economists expect GDP could shrink at as much as a 46% annualized rate in the second quarter. The economy contracted at a 5% pace in the January-March quarter, the deepest downturn since the 2007-09 Great Recession.