Congressional Republicans moved to hasten an overhaul of the U.S. tax code on Thursday, while Federal Reserve officials warned in rare public remarks that President Donald Trump's tax plan could lead to inflation and unsustainable federal debt.

In a procedural step forward, the Republican-controlled House of Representatives approved by a 219-206 vote a fiscal 2018 spending blueprint to help them advance an eventual tax bill.

The blueprint contains a legislative tool that would let Republicans bypass Democrats and pass a tax bill by a simple majority vote in the Senate, where they hold 52 of 100 seats.

Still, months of debate in Congress lie ahead on crafting actual tax legislation, intended by Republicans to deliver on one of their key campaign promises of the 2016 elections.

Trump and top Republicans in Congress hope to enact a package of tax cuts for corporations, small businesses and individuals before January, pledging that sharply lower taxes will boost U.S. economic growth, jobs and wages.

Short-term gain

But Federal Reserve officials questioned this rosy scenario, saying the Republicans' proposed tax cuts could deliver a short-term growth surge, but also bring high inflation, burdensome government debt levels and an eventual return to subpar economic growth.

Unless targeted to raise productivity and underlying potential, San Francisco Fed President John Williams said, a tax cut could feed "unsustainable" growth that would ultimately be undone by asset price bubbles, inflation and possible recession.

Fed officials generally refrain from commenting on fiscal policy, but the Trump administration is proposing $6 trillion in personal and corporate tax cuts at a time when many economists feel the country does not need massive stimulus.

Separately, the Republican-led Senate Budget Committee was expected to approve its own budget resolution later on Thursday and send it to the full Senate for a vote, likely in two weeks.

The procedural actions in Congress set the stage for a possible clash among Republicans that could delay consideration of a bill. While the House budget prohibits tax reform from adding to the deficit, the Senate's version would allow $1.5 trillion in lost revenue over a decade.

House and Senate Republicans must iron out their differences and approve the same budget resolution before it can provide Republicans the legislative advantage known as reconciliation.

The criticism from the Fed was only the latest to hit the Republican tax plan.

It has also been assailed by Democrats as benefiting the wealthiest Americans while raising taxes on middle-class Americans and cutting spending on social programs, including the Medicare and Medicaid health care programs.

Republican dissension

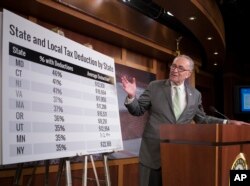

Republican lawmakers are questioning a proposal to help pay for tax cuts by eliminating popular tax deductions. Some Republican fiscal hawks have warned they will not back a tax reform package that adds to the deficit.

The Trump tax plan would add about $2.4 trillion to the deficit over the next decade, said the nonpartisan Tax Policy Center, a Washington tax think tank, at a time when the national debt already exceeds $20 trillion.

"Where is all that money coming from?" Kentucky Representative John Yarmuth, the top Democrat on the House Budget Committee, asked on the House floor. "If you're listening to this and you're not a millionaire, probably from you."

In the Senate, Democrats sought to hamstring the Republican budget resolution with amendments that would prevent tax legislation from benefiting the wealthy, raising taxes on the middle class and adding to the deficit.

Democrats also called for an end to reconciliation, the legislative procedure that would sideline them in a Senate vote.