Stock markets in Japan and China saw sharp declines Tuesday, following selloffs Monday in U.S. markets.

The Nikkei fell by about five percent, while the Shanghai Composite Index was down about two percent.

In Monday's trading, the S&P 500 finished down more than two percent and the Dow off nearly three percent.

U.S. President Donald Trump is blaming the Federal Reserve (central bank) for stock market declines and other economic problems.

In tweets, Trump has said the only U.S. economic problem is rising interest rates. He accused Fed chief Jerome Powell of not understanding the market and damaging the economy with rate hikes.

The Fed slashed the key interest rate nearly to zero to boost growth during the recession that started in 2007. The central bank kept rates low for several years.

Eventually, growth recovered, and unemployment dropped to its lowest level in 49 years, and Fed officials judged that the emergency stimulus was no longer needed.

Fed leaders voted to reduce the stimulus by raising interest rates gradually. The concern was that too much stimulus could spark inflation. Experts say such a sharp increase in prices could prompt a damaging cycle of price increases leading to rising wage demands, which would spark another round of price hikes.

Analysts quoted in the financial press say Trump's attacks on the Fed make investors worry that the central bank might lose the independence that allows it to make decisions based on economic factors rather than what is politically popular.

Some economists say investor confidence has also been shaken by Trump's tariffs on major trading partners. Raising trade costs can reduce trade and cutting trade cuts demand for goods and services, which slows economic growth.

Investor confidence, or a lack of it, can cause stock and other markets to decline as worried stock holders sell shares and prospective investors stop buying available stocks. When buyer demand drops, prices fall.

Another factor hurting investor confidence is the political impasse in Washington over money for Trump's border wall with Mexico. The bickering means Trump and congress can not agree on spending priorities, so legislation paying some government employees has lapsed.

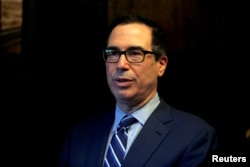

In an effort to calm turbulent markets, Treasury Secretary Steve Mnuchin spoke with leaders of top U.S. banks in an unusual session Sunday. He says they have the money they need for routine operations.