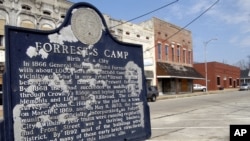

When the Chinese company Shandong Ruyi Technology Group announced in May 2017 that it would invest $410 million in a textile factory in the town of Forrest City, Arkansas, which would create 800 local jobs, Larry Bryant, then the mayor, said he "jumped with joy."

Three years later, however, "disappointment" is the refrain most commonly heard from locals.

Kay Brockwell, CEO of the local consulting firm Future Focus Development Solutions, is the key coordinator for the project. She told VOA that Ruyi had sent a team from China to Forrest City to plan the initial project after announcing the investment in 2017. The team left six months later, saying they were "going back for meetings" ... and never returned.

Brockwell said that there has been no construction or renovation at the $6 million site since 2018. There are also no jobs for the town of 14,000 located on the Mississippi River Delta.

"Everyone is tremendously disappointed. They were looking forward, we were looking forward to the boost it would be to the economy. We were certainly looking forward to the influx of 800 new jobs in the economy. And that just hasn't happened," Brockwell said.

She said she has communicated with Ruyi only once in the past two years — when the vacant plant was damaged by a storm.

When he met with Ruyi in November 2019, Arkansas' Secretary of Commerce, Mike Preston, said that he was told the project might be "resized," but that it would still move forward. Ruyi planned to send people to reevaluate the project in February 2020. But COVID-19 disrupted the plan.

Preston said there is no project timeline now.

But even prior to the pandemic, Ruyi was facing financial problems.

"They had a liquidity issue and their access to capital was not what it was when they started the project," Preston said.

With the ambition of transforming itself into the LVMH of China, the company has been acquiring foreign fashion brands since 2010. The frequency and size of these acquisitions significantly increased since 2016, leaving the company with a heavy debt burden. As of June 2019, Ruyi's debt load was RMB 34.1 billion ($4.7 billion), more than triple what it was in 2013, according to an article published by Vogue Business. The group has also suffered repeated downgrades by credit rating agencies and a sharp revenue decline in 2019.

VOA has tried repeatedly to contact Ruyi's headquarters in China via phone calls and emails, but hasn't received any comment regarding the company's future plan for the investment in Forrest City.

Trade war

The U.S.-China trade war officially started shortly after the announcement of the investment plan in Forrest City. The U.S. imposed a 10% tariff on textile machinery products imported from China, and later increased the rate to 25%, while China imposed a 25% tariff on textile products originating in the United States. These tariffs represent a significant increase in costs for an Arkansas textile mill that needs to import textile machinery and equipment from China and re-export some of its products to China.

The investment in Forrest City has become a microcosm of the trend of Chinese direct investment in the United States in recent years.

Since the start of the U.S.-China trade war, China's direct investment in the U.S. has plummeted from $29.72 billion in 2017 to $5.39 billion in 2018 and further to $4.78 billion in 2019, according to Rhodium Group.

In addition to the immediate impact of the trade war, the Chinese government has tightened its controls of Outward Foreign Direct Investment in recent years, and the liquidity in China's financial system has come under significant pressure. At the same time, the Committee on Foreign Investment in the United States (CFIUS) has stepped up its scrutiny of Chinese funds.

Impact on community

Under the plan announced in 2017, the textile mill in Forrest City was due to go into production by mid-2018, processing 200,000 tons of cotton per year and hiring workers locally at an average hourly wage of $15.75, nearly double the minimum wage in Arkansas at the time. Preston said the delay in the project has had a big impact on the local community.

"There's a lot of folks who would be willing to go to work today at the facility if it were open," he said. "So it impacts those people that would be employed and working there, impacts the economy around there and the supply chain. Cotton growers would be selling the cotton into the facility and that whole community that would benefit from a facility like that up and running."

Nathan Reed is a local cotton farm owner. He had expected the textile mill to drive up the price of local cotton when it was completed and put into operation.

"Because you don't have the transportation cost through the mill. You know, maybe growing the speck of cotton that they need," said Reed. "So they can get all the cotton they need right within a 30 mile radius of their factory. That definitely would, you would think, lead to more premiums placed on your crop."

Reed had also hoped that the investment from China would help alleviate poverty in the region. But China's tariff increase has led to a sharp drop in demand for U.S. cotton, resulting in a 40% drop in prices. Cotton cultivation is different from other crops because of its long cycle and high degree of specialization. Cotton farmers who cannot plant other crops in their fields can only bite their teeth to endure losses, Reed said.

Preston remained optimistic that Ruyi will eventually meet its investment commitments. He said the raw materials, supply chain and market demand that had attracted companies to invest in Arkansas "still exist."